In a dramatic turn of events, Nvidia, the American AI chip giant, has seen its shares plummet following revelations that the US government is intensifying its antitrust investigation into the firm’s business practices. This development emerged amid concerns that Nvidia might be flouting competition laws by making it challenging for customers to switch to rival semiconductor providers and allegedly penalising those who do not exclusively opt for its AI chips.

The share value of Nvidia dipped by 2.4% in after-hours trading, adding to a nearly 10% fall during the regular session, which erased £212 billion from its market valuation, setting a record for the largest single-day loss ever experienced by a US-based company.

Reports from Bloomberg indicated that the US Department of Justice has issued subpoenas to Nvidia and several other technology companies, compelling them to submit required information by law. This step suggests a significant escalation in the antitrust investigation against Nvidia, hinting at the possibility of a formal complaint being lodged in the near future.

The recent sell-off came against the backdrop of a broader market downturn, triggered by disappointing US manufacturing data that has led to growing investor unease about the American economy’s future prospects. The Institute for Supply Management’s latest report indicated a contraction in manufacturing activity, with declines in new orders, production output, and employment levels, contributing to a downturn in both the S&P 500 and Nasdaq Composite indices.

The downturn in Nvidia’s share price also reflects wider market volatility, particularly among companies involved in artificial intelligence, including tech behemoths like Google, Apple, and Amazon. This volatility is fuelled by investor concerns over the time it might take for the AI sector to deliver tangible results and substantial returns, despite the current enthusiasm surrounding the technology.

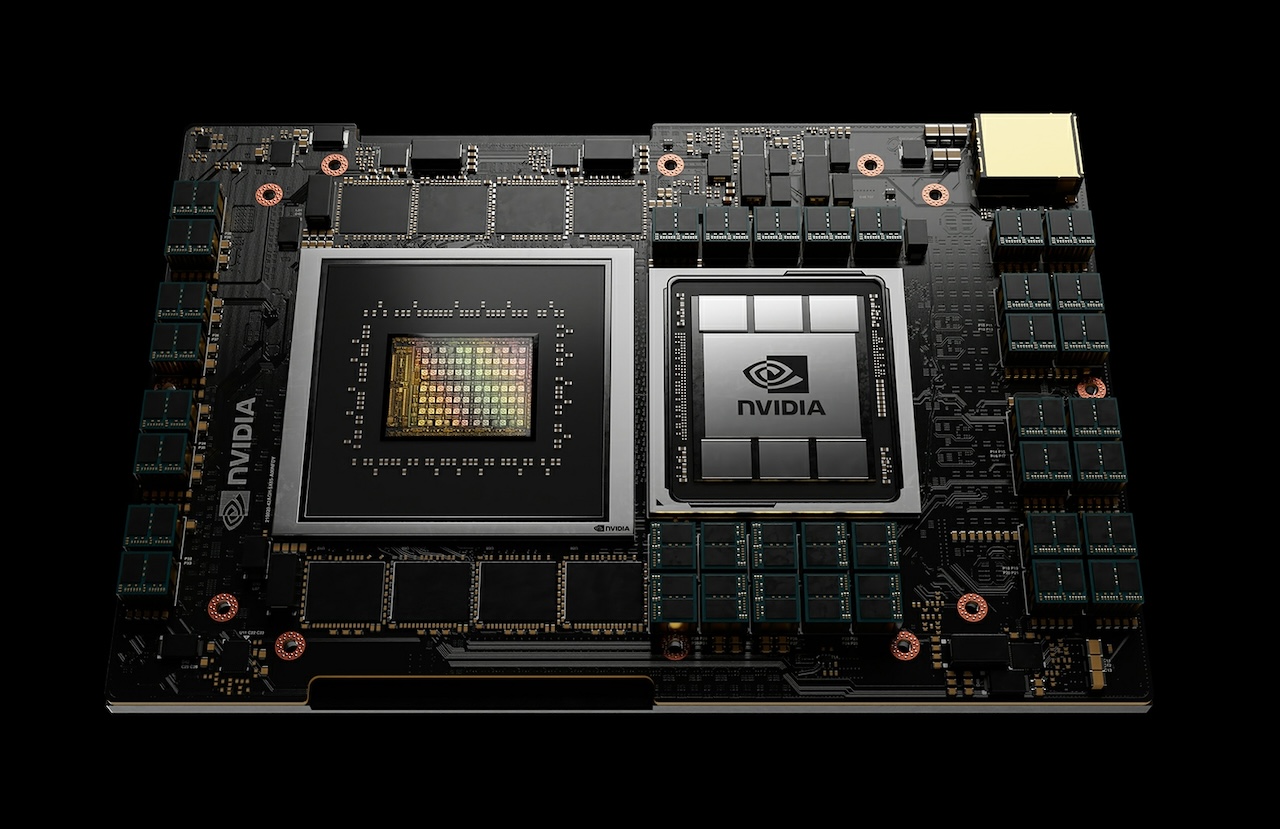

Founded in 1993, Nvidia initially made its mark by designing chips for video games but later pivoted to capitalise on the cryptocurrency frenzy with its processing technologies. More recently, the company has focused on artificial intelligence, propelled by the burgeoning interest in large language models. Despite reporting a significant increase in revenues, the company’s future growth prospects, especially concerning its next-generation AI chips named Blackwell, have been a source of concern for investors.

Responding to the investigation, a representative from Nvidia emphasised the company’s commitment to winning on merit, highlighting the superior benchmark results and value offered to customers, who are free to select the solutions that best meet their needs.

News Team